It’s easy to imagine this scenario:

You consider yourself a savvy person, and when it comes to your phone, you always check your caller ID before you answer. If you don’t recognize the caller’s name and/or company name and/or phone number, you let the call go to voicemail.

It’s likely a robocall, and you’ll check it later. Maybe.

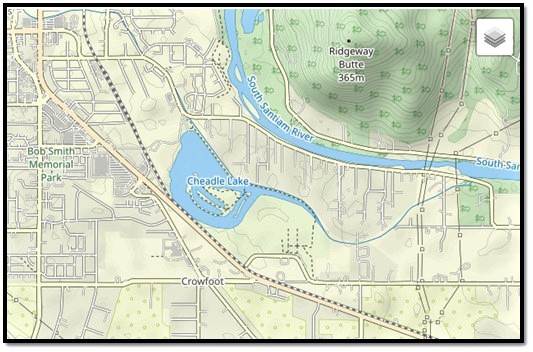

But now your phone rings, and since you live in San Diego County, here’s what you see:

San Diego Gas & Electric – SDG&E is your utility company.

“Hmmm,” you think. “Why would SDG&E be calling me? Oh, hell – are they calling to tell me there’s going to be a rolling blackout? Or there’s some sort of problem in my area?”

Your savvy self is suspicious, but you decide to answer. If it is SDG&E and if it is bad news, there’s no sense in postponing it.

You: Hello?

SDG&E: Hello, this is Ashley Martin – I’m a customer service representative from SDG&E. Your telephone number, 619-111-1234, is identified with SDG&E account number 123456789 and home address of 1234 Almond Street, residence of Frederick and Catherine Simmons. Am I speaking to Mr. Simmons?

(You’re starting to feel less suspicious – this isn’t a robocall, and the connection is clear – not that distorted long-distance-eastern-Europe stuff. She has your correct telephone number, address and names. As she’s talking, you’re opening your laptop, googling SDG&E and logging into your account.)

You: Yes, this is Fred Simmons. (You’ve got your account open on your laptop.) What did you say that account number was?

SDG&E: That account number is 123456789.

(That’s your account number, so your suspicion level decreases a bit more.)

You: Is there a problem?

SDG&E: Mr. Simmons, on October 15 we notified all SDG&E customers by text and/or email that we were changing our payment system, and all customers who pay via direct deposit from their bank needed to contact their bank to update their information.

(She knows you pay SDG&E by direct deposit from your bank – she must be on the level. But…)

SDG&E: Our records indicate that your SDG&E account number 12345689 has not been updated, so your current balance of $566.12, payable on or before October 19, is now more than 30 days overdue. This means your gas and electricity service will be shut off at 8pm this evening.

You: That can’t be right. And I never got an email or text from SDG&E about anything. I’m on my laptop – I’m going to open my bank account and check. I’m sure that payment went through.

SDG&E: Go right ahead, I’ll stand by.

(Silence while you access your bank account.)

You: Yes, I’m showing a payment of $566.12 to SDG&E on October 19.

SDG&E: SDG&E shows no record of that payment, so there appears to be an issue between you and your bank, Mr. Simmons.

You: I’ll call the bank and get this straightened out and –

SDG&E: Mr. Simmons, since it’s 7:35pm now and you’re going to lose power in 25 minutes, may I suggest you provide your credit card number and we can handle your overdue payment that way?

You’ve now gone from savvy – to scared. Your only option is to give this person your credit card number or your power is going to be shut off.

What do you do?

Hang up.

Here’s why:

According to the article,

“SDG&E has received 178 reports of scams this year that have cost customers about $173,000. In one instance this spring, an impersonator told a homeowners association its electronic payment did not go through. The HOA made multiple payments and ended up losing $26,000.

“Pacific Gas & Electric, the largest investor-owned utility in California, has reported a surge in scams. So far this year, PG&E has received more than 23,000 reports from customers who combined to get swindled out of nearly $1.3 million in fraudulent payments. That’s more than twice the number of reports PG&E received in all of 2021.”

And this fraud isn’t limited to California – the article referenced this source:

Which said:

“Utility imposter scams were the third-most common scam category according to consumer claims tracked by the FTC. The Better Business Bureau (BBB) describes common scams involving utility company imposters threatening to shut off services if payment is not immediately collected. According to the BBB, utility scam victims experience a median financial loss of $500.”

And the scammers don’t limit themselves to residential customers, says the Union-Tribune:

“Another ruse involves scammers calling restaurateurs just prior to lunch hour, threatening an immediate power disconnection. Owners and managers worried about losing their noontime crowd may be vulnerable to fraudulent demands for payment.”

The problems – and the losses – have become so widespread, especially during the holidays, that this group:

Declared November 16 as Utilities Scams Awareness Day:

Ah, for the good old days. When the only things on the November calendar were things like National Nachos Day (November 6), National Play Monopoly Day (November 19) and, of course – Thanksgiving.

SDG&E assures us that they will never call customers and tell them they must make an immediate payment over the phone or their service will be disconnected. And:

“As for suspicious actors who may show up at your door, SDG&E says all of its employees on company business are required to carry a photo ID badge.”

If someone from SDG&E had called me as in my imagined call at the start of this post, I would have answered. Could I have fallen for this scam?

Here’s what SDG&E says: If someone calls and asks for a payment, hang up and call SDG&E customer service. If you get a text or email from SDG&E that looks suspicious: Ditto. If someone shows up unexpectedly at your door, even if they show SDG&E ID: Ditto.

Here’s hoping your utility company is offering the same advice.

Now: We know that thieves have always been with us.

And thieves will always be with us.

Like those guys in the image at the top of this post. They aren’t putting their revered pharaoh to rest.

They’re the guys who came in right after the revered pharaoh was put to rest:

Tomb robbers:

Thieves will always be with us, so it’s up to me to take what steps I can to protect myself, and that includes lessons I’ve now learned about utility scammers.

And also this, from a story on – no coincidence – National Scam Awareness Day.

It’s about “trending crimes” I’d never heard of – have you?

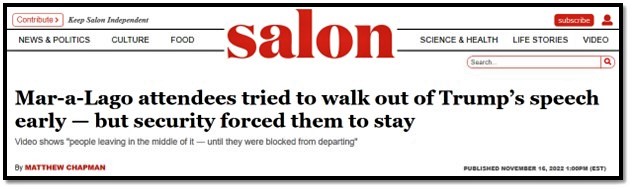

“Thieves are stealing paper checks from mailboxes, ‘washing’ them with nail polish remover, and filling in new amounts and payees – causing endless grief for victims and their banks, which typically foot the bill.”

“Nail polish remover” as a weapon?

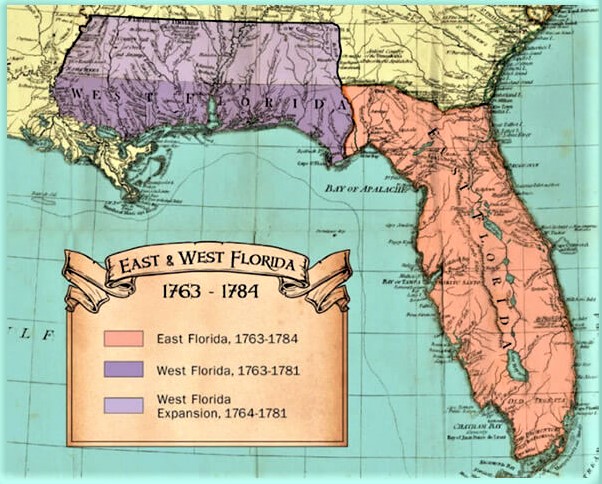

Here’s an example of a washed check:

The victims of this washed check are a veteran and his wife. He mailed a $230 check at a post office and now they’re out nearly $5,000 because the bank hasn’t yet agreed to a refund.

He paid an account by check.

My husband and I still have a few accounts we pay by check.

We’re going to change that.

And I don’t mean later, I mean…